Durham-Chapel Hill MSA Industrial Market Report – Q4 2025

By Carey Greene, Senior Advisor / Partner

The industrial real estate market in the Durham–Chapel Hill MSA continued its transition during the fourth quarter of 2025, with rising vacancies, moderating rent growth, and a construction pipeline that remains active but increasingly selective. While fundamentals remain sound over the long term, near-term conditions reflect a market digesting several years of elevated development activity amid a more measured pace of demand.

A snapshot of the Greater Durham industrial market and key trends follows. But first, a summary of Durham’s Letter to Industry from late December.

🎄 A Lump of Coal for East Durham Landowners

Just days before Christmas, the City of Durham delivered East Durham landowners a lump of coal in the form of a “Letter to Industry.” On December 19, 2025, the City issued one such letter regarding the Goose Creek Outfall sanitary sewer basin, imposing immediate development constraints across a large portion of East Durham. Effective immediately, new development applications requiring sewer service within the Goose Creek Outfall Service Area must obtain a Utility Extension Agreement, with no new sewer capacity expected until phased infrastructure improvements are completed—currently projected into 2029 and 2030.

While these upgrades are necessary and positive in the long term, the near-term impact is clear: land within the affected area, for all intents and purposes, faces a moratorium, with downward pressure on values as buyers delay purchases or adjust underwriting assumptions. In some cases, owners have already spent gobs of money on land purchases, design and engineering, only to be told they can’t get building permits for 3-4 years.

Full City memo: https://tinyurl.com/5t4hh9xk

Key Market Indicators for Q4 2025

Market Total SF: 59.6MM SF

Vacancy Rate: 9.1% (EOY 2025)

Market Asking Rent: $11.74/SF

Market Asking Rent Growth: 2.9%

12 Mo Net Absorption: 1.5MM SF

Under Construction: 2.8MM SF (6.1% of inventory, 48% pre-leased)

12 Mo Deliveries: 3.3MM SF

Sales Volume: $695MM in 2025 (highest since 2022)

Avg Price per SF: $157

Construction, Absorption, and Vacancy

Industrial vacancies continued to trend upward in Q4 2025 as new supply outpaced tenant demand. Vacancy in the Durham industrial market rose further during the quarter, driven primarily by the delivery of new speculative product and slower absorption relative to recent historical norms.

Over the trailing 12 months, Durham has seen several million square feet of new industrial deliveries, well above the market’s long-term annual average. Net absorption remained positive but lagged deliveries, resulting in a gradual loosening of market conditions.

Despite rising vacancies, it is important to note that much of the new supply consists of modern, Class A facilities positioned to serve advanced manufacturing, life sciences, and logistics users—sectors that continue to view the Triangle as a long-term growth market.

Rent Growth Continues to Cool

Industrial rent growth in Greater Durham continued to decelerate during Q4, reflecting increased availability and heightened competition among landlords. While asking rents are still rising on a year-over-year basis, the pace of growth has slowed meaningfully from the peak levels observed in 2022 and early 2023.

Even with this slowdown, Durham’s rent growth remains above the national average, underscoring the region’s relative strength compared to many U.S. industrial markets where vacancies have risen more sharply and rent growth has flattened or turned negative.

Construction Costs & Tariffs – A Growing Headwind

Construction material costs remain a meaningful challenge for developers. Despite modest month-over-month relief late in the year, U.S. import tariffs drove construction material prices up approximately 2.8% year-over-year in 2025, contributing to a 42.4% cumulative increase in material costs since early 2020. Retail and warehouse construction costs have risen more than 46% over that period, with apartment construction costs not far behind.

Materials most exposed to tariffs continue to see outsized increases. Copper wire and cable prices rose sharply late in the year and remain up more than 20% year-over-year, while certain metal-based imported materials experienced even steeper annual increases. While December brought a slight pullback in overall material pricing, elevated input costs continue to pressure development feasibility, pro formas, and land values—particularly for projects already contending with higher interest rates and infrastructure constraints.

Economic Development – Fewer Announcements, Still Meaningful Impact

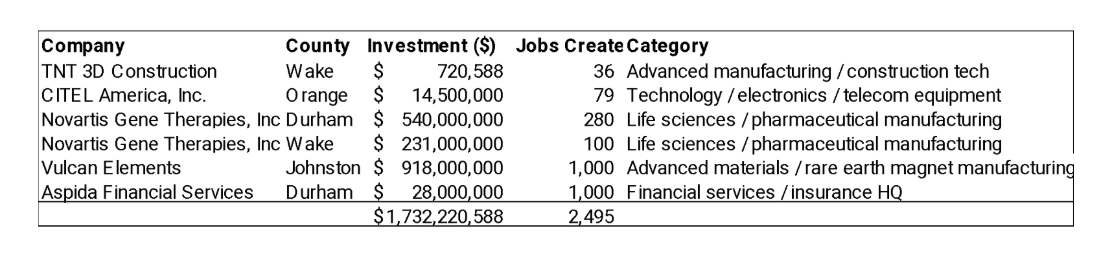

Economic development activity in Q4 2025 was lighter than in prior quarters in terms of overall volume (though $1.7B isn’t too shabby), but several announcements carried outsized importance for the region and reinforce Durham’s long-term growth trajectory.

The most significant announcement was Novartis Gene Therapies, Inc., which unveiled a major multi-site expansion across Durham and Wake Counties totaling over $770 million in new investment and approximately 380 new jobs. The Durham portion of the project represents a substantial expansion of the region’s life sciences and pharmaceutical manufacturing footprint, further strengthening Research Triangle Park’s position as a global hub for advanced therapeutics and biomanufacturing.

Major Takeaways from Q4 2025 – Carey’s $0.02

A lump of coal for East Durham landowners: Sewer capacity constraints tied to the Goose Creek Outfall basin will delay new development until phased infrastructure upgrades are completed (currently projected into 2029–2030), placing near-term downward pressure on land values and extending hold periods.

The Durham industrial market is normalizing after several years of rapid expansion. Vacancy has risen as supply has outpaced near-term demand and rent growth has cooled accordingly.

Despite this normalization, demand drivers tied to life sciences, advanced manufacturing, and logistics remain firmly in place, supporting a positive long-term outlook.

Tariffs and construction costs matter: Elevated material pricing—particularly for tariff-sensitive metals—continues to challenge development feasibility and land underwriting, even as headline inflation shows signs of easing.

For tenants, elevated vacancies—particularly in newer speculative projects—may create opportunities to negotiate more favorable lease terms in the near term.

Looking ahead, infrastructure capacity, construction costs, and entitlement timing are becoming just as important as macro fundamentals when evaluating industrial land and development opportunities in Durham.

Sources: CoStar; Economic Development Partnership of North Carolina (EDAR); City of Durham; SVN Research; Bureau of Labor Statistics; Associated Builders and Contractors; Federal Reserve; MSCI-RCA