Alamance County Industrial Market: Navigating the Rebalancing | Q4 2025 Update

By Brian Alonso, Advisor

The fourth quarter of 2025 marked a definitive closing chapter for a year of recalibration in the industrial sector. While the broader national market faced rising vacancies and a cooling investment climate, Alamance County ended the year with a narrative of stability and local resilience. For property owners, particularly those in the "small-bay" segment, the fundamentals remain overwhelmingly favorable as we head into 2026.

Q4 2025: Local Market Performance

Despite the broader national sector cooling from its post-pandemic highs, key performance indicators for Alamance County reflect a market finding its footing after a period of rapid supply expansion. The vacancy rate successfully stabilized this quarter, halting the previous upward pressure caused by new deliveries outpacing absorption. Perhaps most notably, local asking rents showed significant strength, finishing the year with growth that far outpaced national averages.

Key market indicators for Q4 2025:

Vacancy Rate: 10.4%

Market Total SF: 30.9M

Market Asking Rent: $6.28/SF

Market Asking Rent Growth: 3.5%

12 Mo Net Absorption in SF: (277K)

Under Construction: 127,500 SF

Source: CoStar Market Research

The Small-Bay Advantage: Assets Under 50,000 SF

Owners of properties under 50,000 square feet are currently operating in a specialized "market within a market" that continues to significantly outperform the larger distribution segment. While massive "big-box" logistics facilities have faced rising vacancies due to a surge in new supply, the "small-bay" tier remains characterized by tighter availability and significantly higher liquidity. Recent local transaction data highlights this strength, with the average industrial property sold in our market measuring 16,846 square feet. This scarcity of smaller assets has translated into a substantial pricing premium. Furthermore, the lack of new speculative construction in this size range ensures that existing small-bay owners are well-insulated from the supply competition affecting the broader logistics sector.

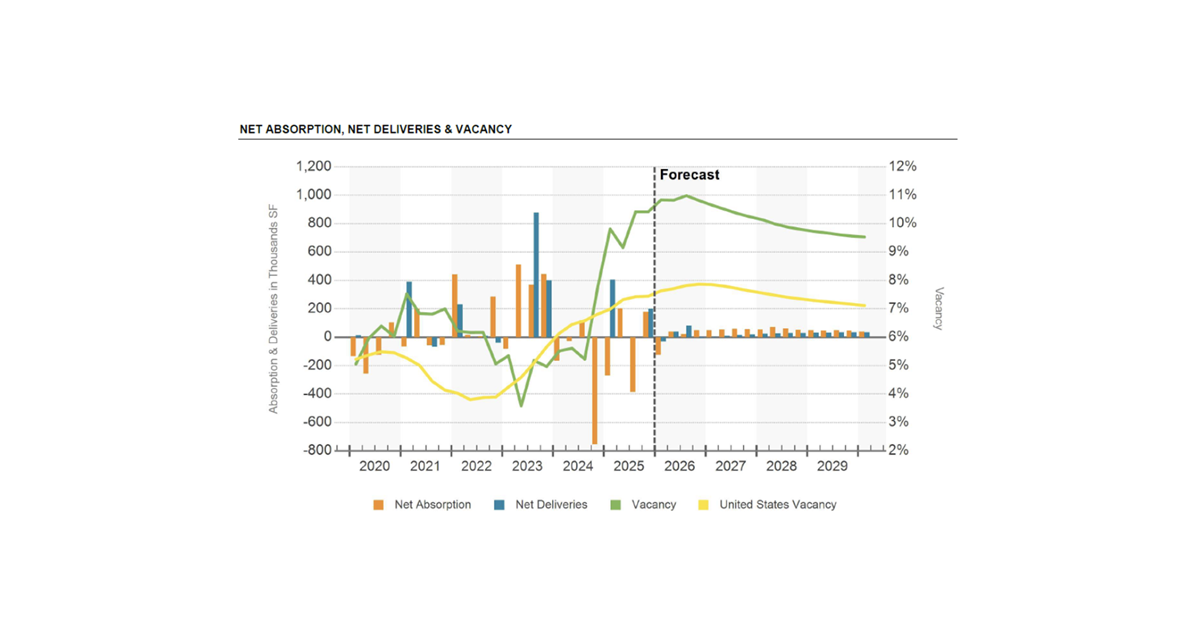

National Industrial Context: A Rebalancing Phase

Across the United States, the industrial sector has entered a necessary "rebalancing phase" following years of historic growth. National vacancy rates rose modestly throughout 2025, reaching 7.3% as record amounts of new supply delivered over the previous 24 months. However, the underlying demand remains robust, with the U.S. industrial market recording positive net absorption for the 14th consecutive year. This indicates that while the pace has moderated, occupiers are still actively expanding their footprints and taking more space than they are vacating.

Macroeconomic Tailwinds

Several year-end economic shifts are providing a solid foundation for renewed momentum in 2026. The Federal Reserve’s decision to cut benchmark interest rates by 25 basis points in December—marking the third consecutive cut—is a dovish move expected to provide relief to developers and invigorate new business expansion. Supporting this is a robust GDP, which expanded at an annualized rate of 4.3% in the third quarter, significantly outperforming consensus estimates and driven by expanded consumer and government spending.

North Carolina: 2025 State of the Year

Alamance County continues to benefit from North Carolina’s premier status as the top state for business and workforce development. In early 2026, the state was named the 2025 State of the Year for economic development, a recognition of its record-breaking performance across capital investments and job creation. In 2025 alone, the state secured over $24 billion in capital investment and more than 35,000 new job commitments. High-profile regional projects, such as the new JetZero airplane manufacturing facility in nearby Greensboro, are expected to drive significant secondary demand for suppliers and industrial services throughout Alamance County.

Looking Ahead to 2026

As the local construction pipeline thins to just 127,500 square feet—a dramatic reduction from the 10-year average of 470,000 square feet—the market is poised for a period of vacancy compression. With new competition stalled and demand inevitably absorbing current supply, property owners are in an excellent position to see renewed momentum in both leasing activity and asset appreciation.