May 2, 2025

Durham-Chapel Hill MSA Industrial

Market Report - Q1 2025

The industrial market in the Durham-Chapel Hill MSA (which we will refer to as “Greater Durham” in this report) remains a story of strong construction activity and resilient demand - but also increasing vacancies and slower rent growth as supply has outpaced absorption in recent quarters. Despite these trends, the region continues to attract significant investment and development interest, fueled by robust population and economic growth, as well as its well-established life sciences and advanced manufacturing sectors.

Industrial Snapshot

Construction, Absorption, and Vacancy

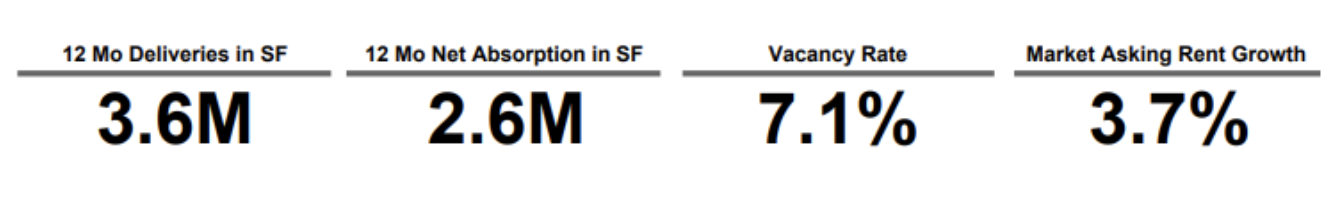

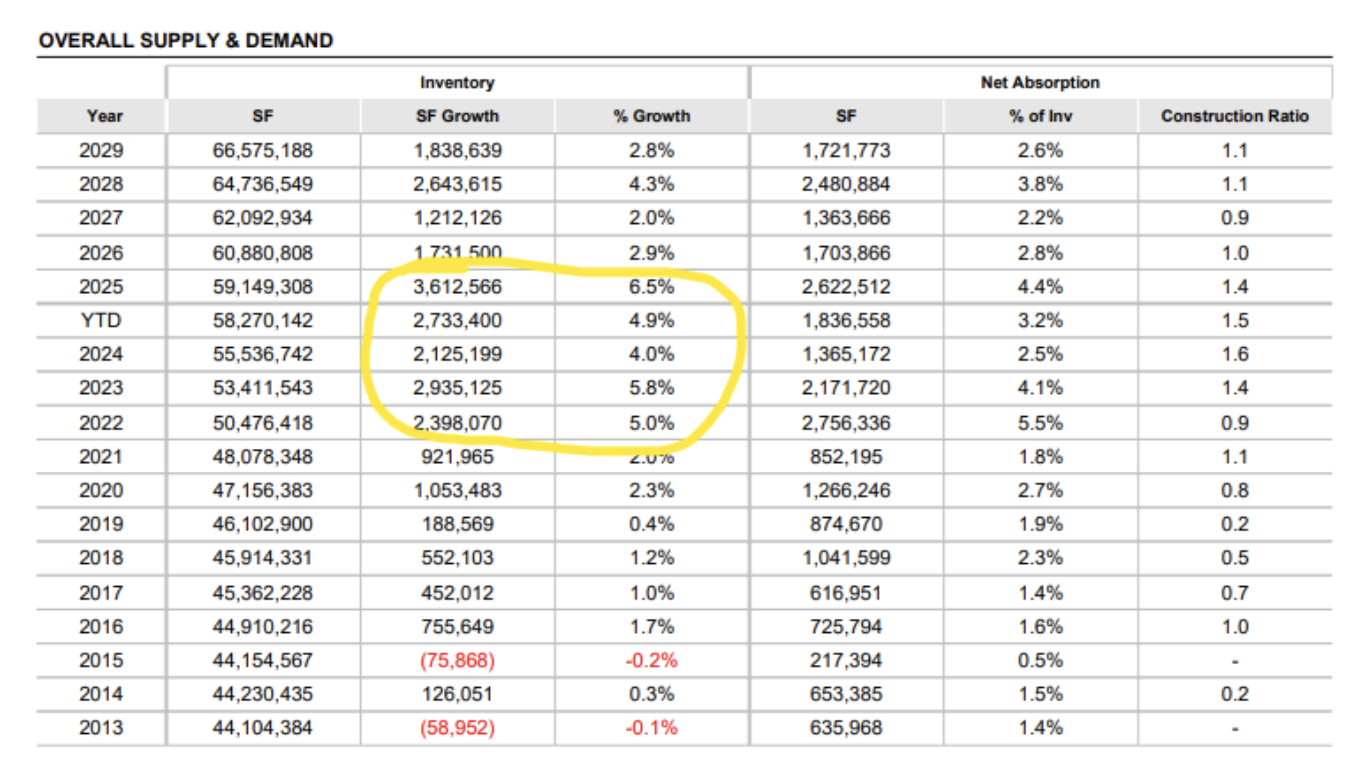

Vacancies in the industrial sector have climbed steadily over the past year. As of Q1 2025, Greater Durham’s industrial vacancy rate stands at 7.1%, up from 5.9% at the beginning of 2024. This increase is directly tied to a wave of new supply coming online - 3.6 million square feet of industrial space delivered over the last 12 months, far exceeding the market’s 10-year annual average.

Despite the increase in available space, net absorption totaled 2.6 million SF, exactly on par with the market's historical average. Notably, activity has been concentrated in Chatham and Orange Counties. A highlight includes two buildings totaling 314,000 SF in the Apex Gateway development, both of which were fully leased upon completion in November 2024.

Greater Durham now has 3.3 million SF of industrial space under construction, with large-scale projects like Wolfspeed’s silicon carbide materials factory leading the way in the Chatham County submarket.

The information in the chart that follows, with data provided by CoStar, displays what’s happening in a nutshell. Deliveries over the last few years have outpaced the amount of space that has been absorbed, causing vacancy rates to go up. The growth of asking rents has decelerated as a result. You can see just how much inventory has been delivered since 2022 relative to other years.

Rents Continue to Rise, But Growth Slows

Industrial rent growth continues to cool but remains higher than national trends. Asking rents in Greater Durham increased 3.9% over the past 12 months, compared to 2.1% nationally. This marks more than two years of decelerating rent growth for the market, as rising vacancies put downward pressure on lease rates.

Although growth is slowing, Greater Durham’s rents remain elevated by regional demand for e-commerce, logistics, and specialized space to support the thriving life sciences and biotech industries.

Economic Development Update

Durham benefits from a highly educated workforce and a strong mix of economic drivers. Major life sciences and biotech companies - including Pfizer, GlaxoSmithKline, and Biogen - have longstanding presences in Research Triangle Park, the largest research park in the U.S. The area is also attracting advanced manufacturing, with Wolfspeed’s new facility expected to be the world’s largest silicon carbide materials factory. These factors, combined with strong population growth, continue to support industrial space demand.

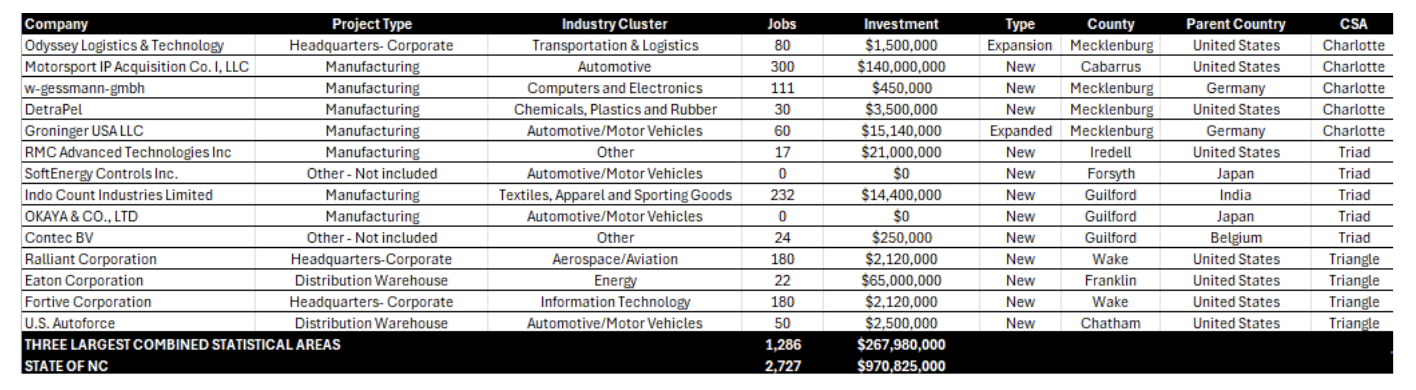

The first quarter, however, proved to be less fruitful from an economic development standpoint for the Triangle as well as the State’s other two major urban areas, the Triad and Charlotte. The chart below captures announcements provided by the Economic Development Partnership of North Carolina, which does an incredible job of assisting local economic development organizations to reel in investment and foster growth. Despite what may be a down quarter relative to others, rest assured there is a tremendous pipeline of potential deals, as I alluded to in my recent LinkedIn post. Notice below that of 14 announcements, six came from companies based outside of the United States. Special thanks to the EDPNC for enhancing my ability to collect this important information!

Investment Trends Hold Steady

Investment activity in Greater Durham's industrial market remains steady. Over the past year, total transaction volume reached $352 million, just below the historical annual average of $367 million. Importantly, the market has seen four consecutive quarters of sales volume over $70 million, a marked improvement from the previous year when no quarter crossed that threshold.

CAREY'S $0.02 and Ponderings:

In past newsletters, I have focused on the very tight industrial market in Greater Durham, where it has been nearly impossible for an owner occupant to purchase a property. Few go on the market, and those that do are often of very low quality at very high prices, which in fairness reflects what happens when there is high demand and low supply. Recently, many of our clients (and future clients!) have been discussing letting go of their properties. Some are retiring and selling their business, others want to take advantage of the appreciation in value they have gained since buying their real estate. Others have expressed concerns over the economy. For a variety of reasons, our conversations seem to be heading in this direction with more industrial property owners. The Ascend Industrial Team is a small sampling in the grand scheme of things, and this is anecdotal at best, but given our many conversations, we expect to see a bit of a loosening up in our corner of the world. If our discussions are indicative of a larger trend, things could get interesting. I know one thing, if you are an owner occupant looking for your next industrial building, be ready to pounce on the right opportunity. When product hits the market, competition will be stiff.

Sources: CoStar, GlobeSt.com, Economic Development Partnership of North Carolina, SVN | Real Estate Associates, SVN International Corporation