July 31, 2025

Alamance County's

Industrial Market Report - Q2 2025

By Brian Alonso, Advisor

The industrial market in the Alamance County/Burlington metropolitan statistical area (MSA) continued its dynamic trajectory in the second quarter of 2025. While facing similar headwinds as the national market, including rising vacancy rates and moderating rent growth, the region's strong fundamentals and strategic location continue to attract investment and drive demand.

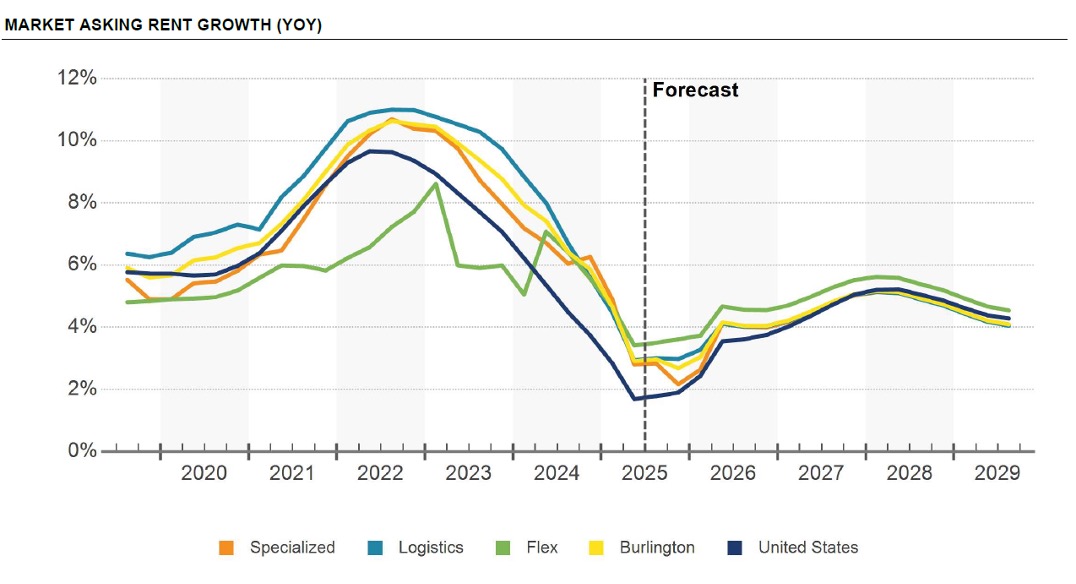

The national industrial real estate market is currently seeing a shift, with vacancy rates climbing for the eleventh consecutive quarter to 7.4% in the second quarter of 2025. This is largely attributed to a significant amount of new supply outpacing current demand. Rent growth across the nation has also slowed to its lowest rate since 2012.

Industrial Snapshot

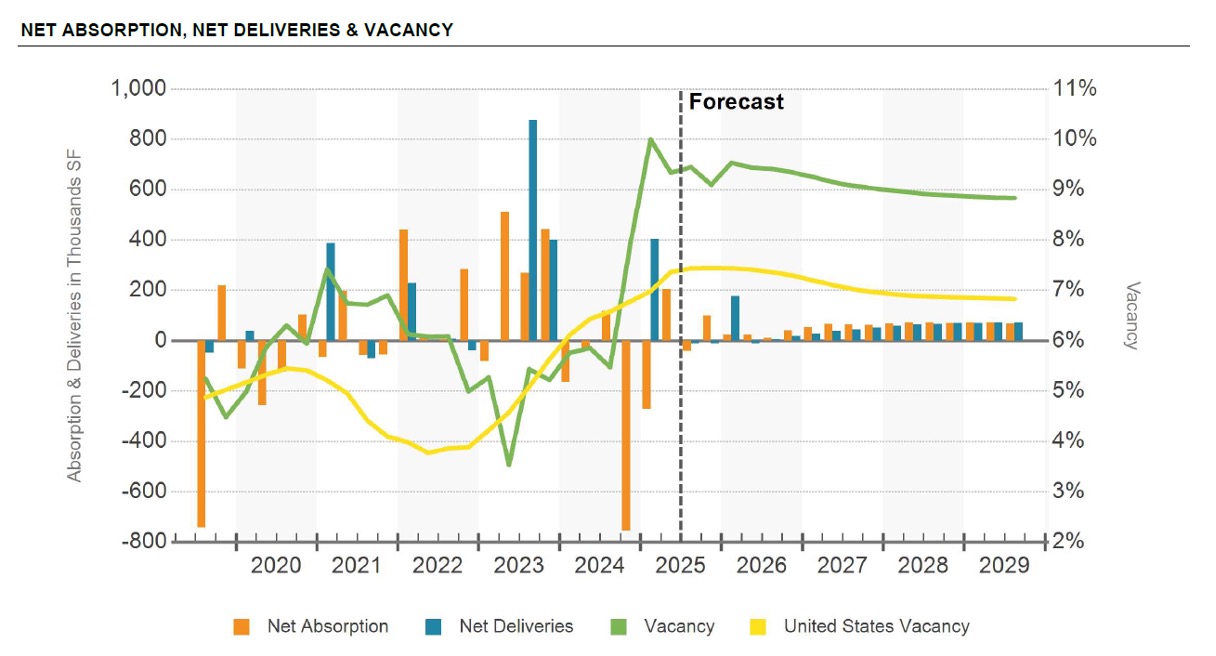

In Alamance County, the industrial vacancy rate stood at 9.3% in the second quarter, a slight increase from the previous quarter, with the market totaling approximately 31.1 million square feet of inventory. Average Asking Market rents for the Burlington area are currently around $6.20 per square foot.

Key market indicators for Q2 2025:

- Vacancy Rate: 9.3%

- Total Market Total SF: 31.1M

- Market Asking Rent Growth: 2.9%

- 12 Mo Net Absorption in SF: (702K)

- 12 Mo Deliveries in SF: 404K

Construction, Absorption, and Vacancy

Over the past year, the Alamance County industrial market has seen the delivery of 404,000 square feet of new space. However, net absorption was negative 702,000 square feet, indicating that more space became available than was leased. This trend aligns with the national picture where new supply has been a key factor in rising vacancy rates.

Currently, there is 190,000 square feet of industrial space under construction in Burlington. A notable project in the works is the 187,500 square foot Class A industrial facility at 1736 Whites Kennel Rd.

Source: CoStar

Rents and Market Segments

Asking rents in Alamance County have seen a year-over-year increase of 2.9%. While this is a moderation from previous quarters, it remains a positive sign of the market's resilience. The average rent for logistics buildings is approximately $6.80 per square foot, while flex properties command a higher rate at $13.10 per square foot, and specialized assets are around $5.10 per square foot.

Source: CoStar

Investment and Economic Outlook

Investment activity in the Alamance County industrial market has cooled, a trend seen in many markets nationally. This is not necessarily due to a lack of interest, but rather a tight inventory and strong demand, leading many property owners to hold onto their assets. The average sales price for industrial properties in the area is estimated at $57 per square foot, with an average market cap rate of 8.4%.

On a broader economic front, the U.S. economy is navigating a period of uncertainty, with concerns over tariffs and their potential impact on growth. However, recent data suggests a rebound in economic growth in the second quarter of 2025. The labor market has remained robust, with consistent job creation and a low unemployment rate.

For Alamance County, local economic development efforts continue to bear fruit. The Alamance County Chamber of Commerce remains active in fostering a pro-business environment, which is crucial for attracting new industries and supporting the expansion of existing ones. The county's strategic location within North Carolina's thriving economic landscape continues to be a major draw for industrial users.

Regional Economic Development Highlights

The broader region surrounding Alamance County has seen a flurry of significant economic development announcements, signaling robust growth and a strong outlook for the future.

- Wake County continues to be a powerhouse for the life sciences and technology sectors. Genentech announced a major new manufacturing facility, a $700 million investment that will create 420 jobs. Additionally, information technology firm Buildops is establishing a new office, bringing 291 jobs and a $771,200 investment.

- Alamance County secured a new project from Custard Stand Chili. The food and beverage manufacturer is investing $3.5 million and creating 10 new jobs, reinforcing the county's appeal for food production and agricultural businesses.

- Guilford County landed several key projects, headlined by a monumental investment from JetZero. The aerospace/aviation company announced a new manufacturing and assembly facility that represents a staggering $4.7 billion investment and is projected to create over 14,500 jobs. Further investments in the county include new manufacturing facilities for Torvan Medical (biotech), and Opsun Systems Inc (energy), which together will add dozens of new jobs and tens of millions in investment.

These developments underscore the economic vitality of the Triad and Triangle regions, creating a positive ripple effect that benefits the entire area, including the industrial market in Alamance County.

Looking Ahead

The Alamance County industrial market is expected to remain a vibrant hub of activity. While the current environment presents some challenges, the long-term outlook remains positive. The limited new construction in the pipeline, both locally and nationally, is expected to lead to a tighter market in the coming year, potentially driving up rents and property values. For businesses looking to invest or operate in the industrial sector, Alamance County continues to offer compelling opportunities.