May 2, 2025

Alamance County Industrial

Market Report - Q1 2025

The industrial market in the Alamance County / Burlington MSA reflects a shift in momentum, with construction activity tapering off and vacancy rates on the rise. While demand remains resilient and the area continues to attract investment interest - particularly from life sciences and advanced manufacturing sectors - recent trends indicate that supply has outpaced absorption. This has led to increasing vacancies and a slowdown in rent growth, suggesting a more cautious outlook for the near term.

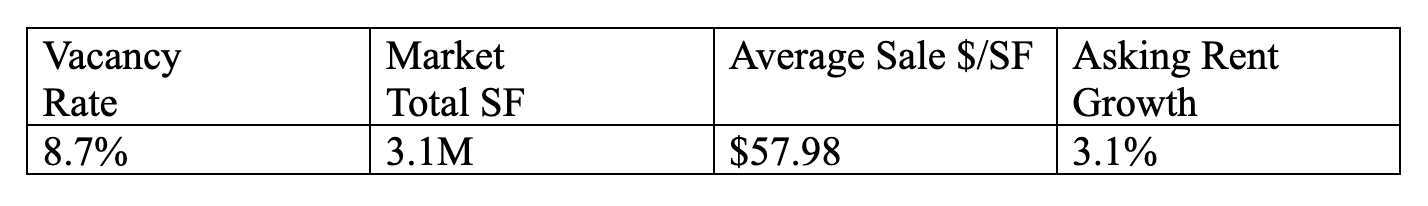

Industrial Snapshot

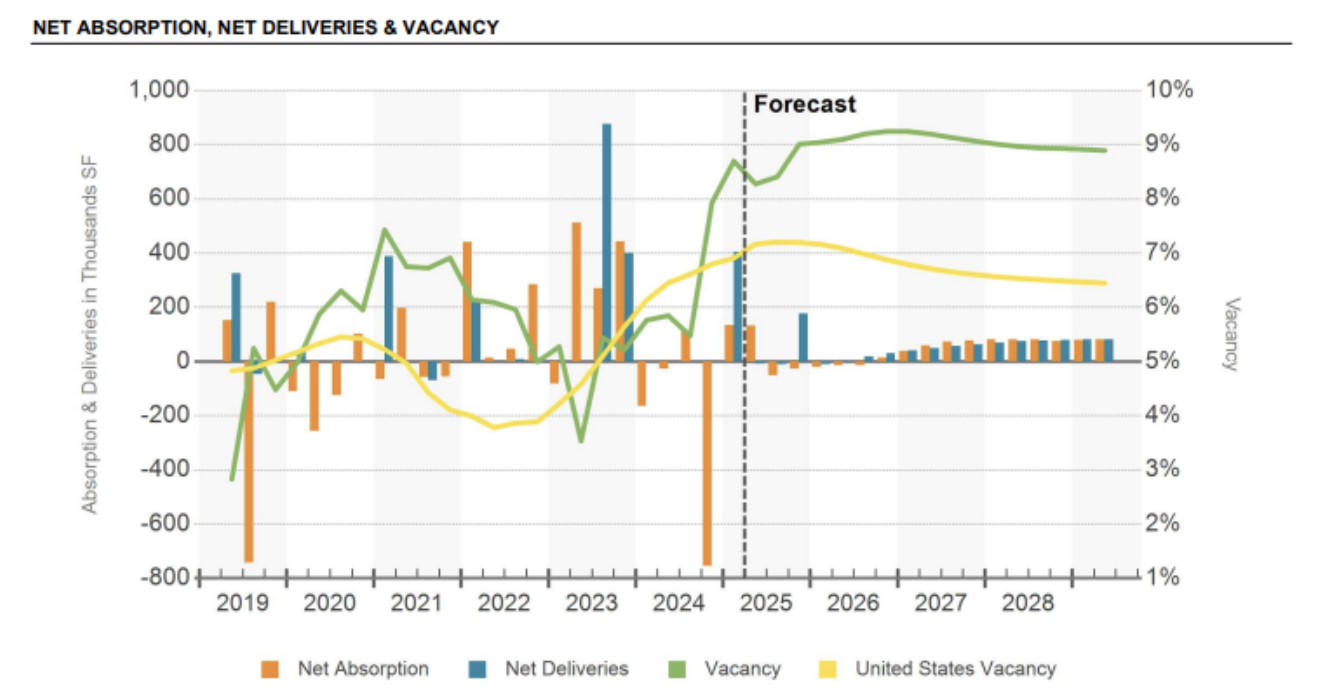

Construction, Absorption, and Vacancy

Vacancies in the industrial sector have climbed steadily over the past year. As of Q1 2025, Alamance County’s industrial vacancy rate stands at 8.7%, up from 5.8% at the beginning of 2024. In the past 10 years, the lowest rate was 1.74% in Q3 2018, and the 10-year average is 5.05%.

Source: CoStar

Source: CoStar

The increase is directly tied to a wave of new construction, with 404,000 SF delivered over the past 12 months and only 345,000 SF net absorbed. Currently, Alamance County has only 190,000 SF under construction, primarily represented by:

1736 Whites Kennel Rd: 187,500 SF, expected delivery Dec 2025, developer: Bunch Construction Inc.

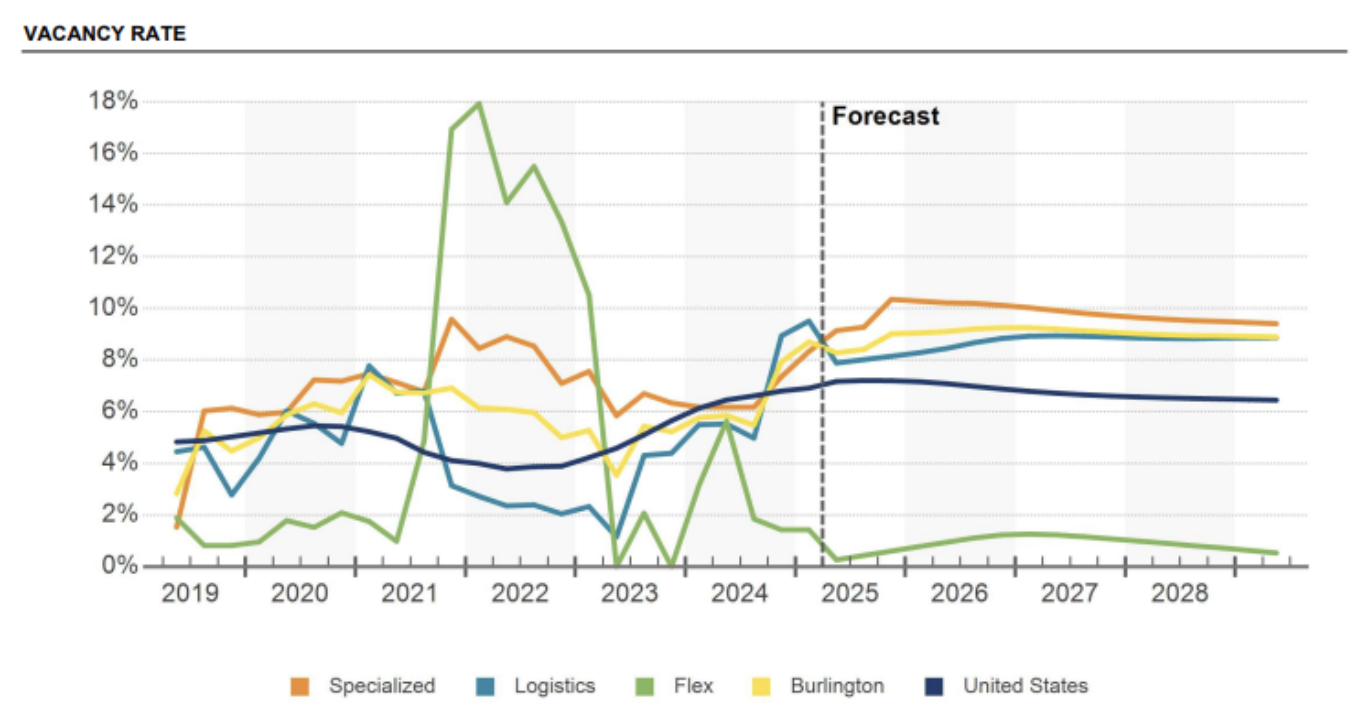

Vacancy is lowest in flex properties, which have the strongest lease-up performance and highest average rents in the market.

Source: CoStar

Source: CoStar

Nationally, construction activity has slowed significantly, with 279 million SF under construction—the lowest total since 2018 and a 60% drop from the 2023 peak. This moderation in supply aligns with a broader trend of developers pausing in response to elevated vacancies.

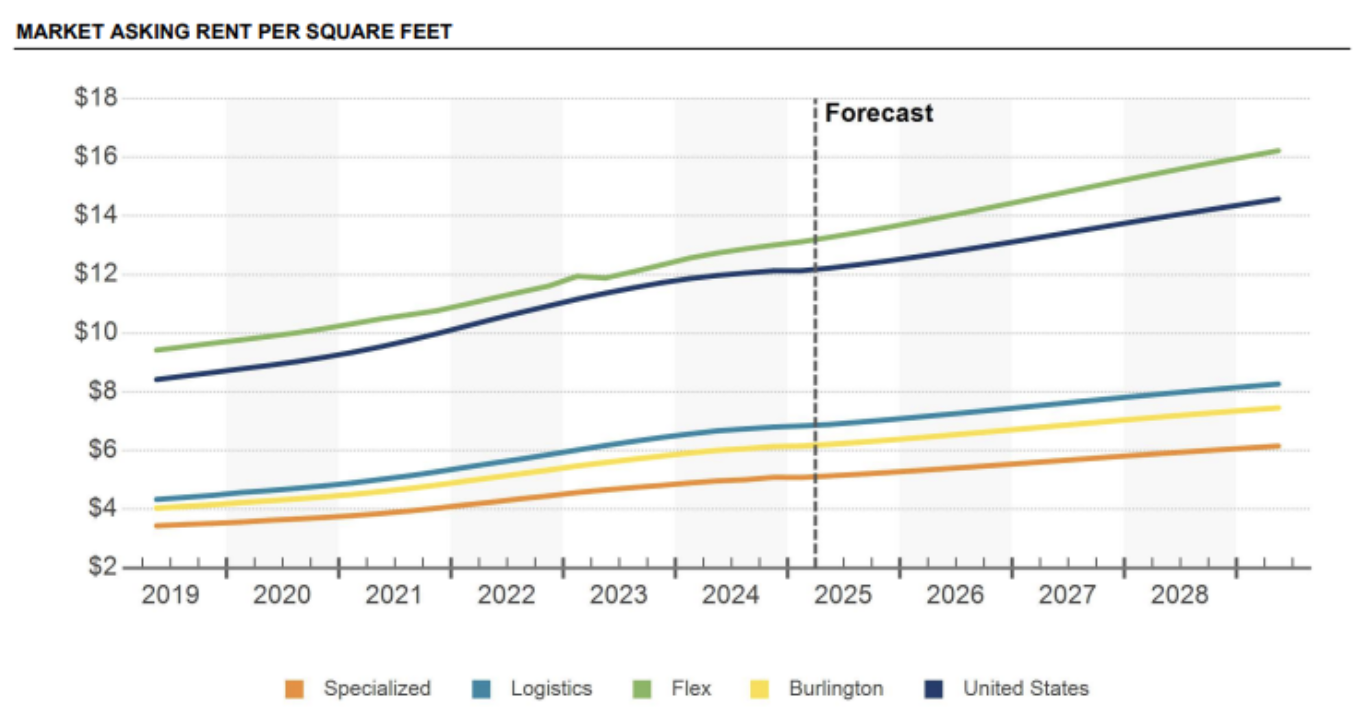

Rents Continue to Rise, But Growth Slows

Industrial rent growth continues to cool but remains higher than national trends. Asking rents in Alamance County increased 3.1% over the past 12 months, compared to 2.1% nationally. This marks more than two years of decelerating rent growth as rising vacancies put downward pressure on rates.

However, rents remain elevated, driven by e-commerce, logistics, and specialized space demand for life sciences and biotech users. Alamance County market averages:

- Logistics: $6.83/SF

- Flex: $13.16/SF

- Specialized Industrial: $5.09/SF

Source: CoStar

Source: CoStar

Nationally, average warehouse/distribution rents rose 6% year-over-year to $10.65/SF. While some overheated markets saw corrections, others (e.g., Los Angeles and NYC Metro) continue to command top-tier pricing.

Investment Trends Hold Steady

Industrial investment activity in Alamance County has shown signs of cooling. The Alamance County market recorded just $15.7 million in total industrial sales over the past year—well below its five-year average of $70.9 million. With only 16 transactions, deal velocity was notably subdued.

However, this low transaction volume is not simply due to a lack of buyer interest or pricing concerns. Rather, it reflects a market constrained by limited supply and strong demand. Many owners are choosing to stay put because relocating is challenging—finding comparable replacement properties is difficult in such a tight inventory environment.

The average cap rate for industrial properties in Alamance County stood at 8.3%, a full percentage point above the national average of 7.3%, indicating a higher perceived risk or softer investor demand.

Estimated average pricing across property types further illustrates the market’s position:

- Logistics: $62/SF

- Flex: $86/SF

- Specialized Industrial: $53/SF

This results in a market-wide average of $59/SF, which is significantly below the national average of $155/SF. The muted transaction volume underscores how constrained inventory—not just economic caution—is limiting market activity in Alamance County.

Economic Development Update

Durham and the greater Triangle area benefit from a highly educated workforce and a strong mix of economic drivers. Major life sciences and biotech companies—Pfizer, GlaxoSmithKline, Biogen—remain deeply embedded in the Research Triangle Park, while new facilities like Wolfspeed's silicon carbide factory are reinforcing the region's high-tech industrial base.

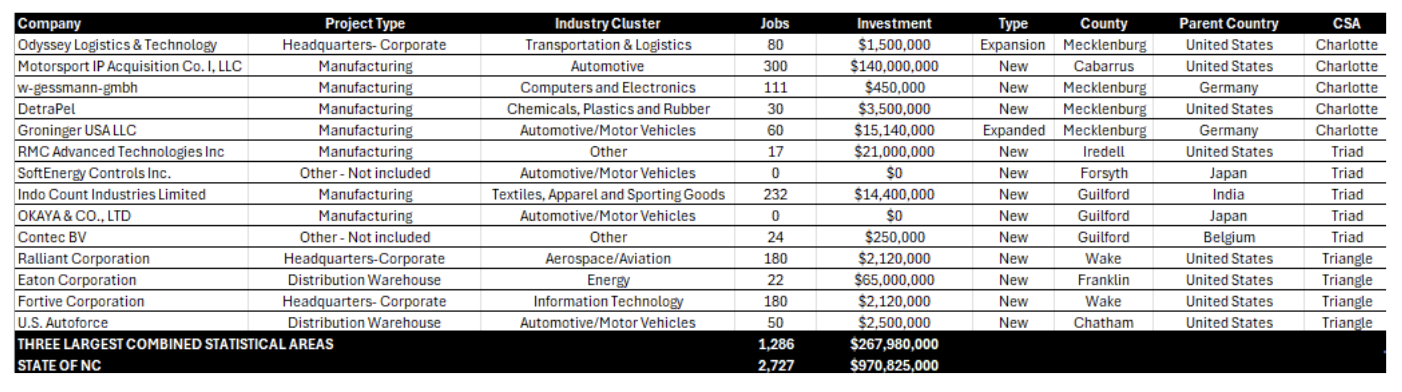

That said, Q1 was quieter in terms of economic development announcements across the Triangle, Triad, and Charlotte. Of 14 announcements statewide, six involved foreign companies, indicating continued international interest despite a lull in domestic project activity. Thanks to the Economic Development Partnership of North Carolina (EDPNC) for aggregating these updates.

BRIAN'S $0.02 and Ponderings:

In past newsletters, I’ve focused on the tight inventory of industrial buildings for sale in Alamance County. Opportunities for owner-occupants to purchase have been rare and expensive. Now, however, we are beginning to hear more owners consider selling. Some are retiring, others are cashing out, and a few are simply reacting to the macroeconomic outlook.

If our clients’ sentiment is representative, we may be entering a new phase of more active ownership turnover. For those seeking to purchase, keep your financing in order and be ready to act quickly. Demand still outpaces quality supply in many cases, and competition remains strong.

Sources: CoStar, GlobeSt.com, Economic Development Partnership of North Carolina, SVN | Real Estate Associates, SVN International Corporation