Alamance County Industrial Market Navigates Shifting Tides in Q3 2025

By Brian Alonso, Advisor

The third quarter of 2025 has been a period of transition for the industrial market in Alamance County. Aligning with national trends, the local market is dealing with the effects of recent supply additions and a broader economic slowdown. However, Alamance County’s core strengths continue to position it as a resilient and attractive market for industrial users and investors.

Nationally, the industrial sector is cooling from its post-pandemic highs. According to the National Association of Realtors, a combination of oversupply and weakening demand led to a 54% year-over-year drop in net absorption, marking the lowest level in a decade. This has pushed the average industrial vacancy rate up to 9.0% as of July.

Industrial Snapshot

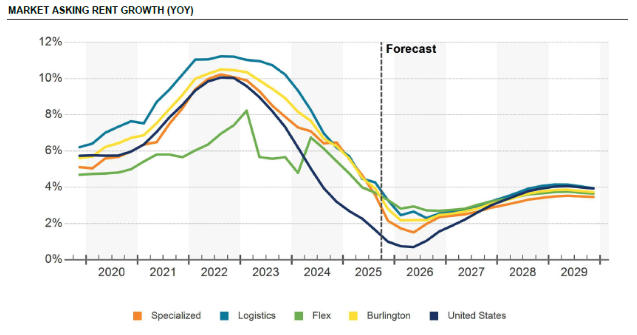

In Alamance County, key performance indicators for Q3 2025 reflect this national recalibration. The vacancy rate has risen as new supply has outpaced absorption over the last year. Despite this, asking rents continue to show positive year-over-year growth.

Key market indicators for Q3 2025:

Vacancy Rate: 10.7%

Market Total SF: 30.8M

Market Asking Rent: $6.22/SF

Market Asking Rent Growth: 3.4%

12 Mo Net Absorption in SF: (966K)

12 Mo Deliveries in SF: 416K

Source: CoStar Market Research

Construction, Absorption, and Vacancy

The increase in vacancy to 10.7% is a direct result of supply outpacing demand over the past 12 months. During that period, the market saw 416,000 square feet of new industrial space delivered, while net absorption was negative 966,000 square feet.

Looking forward, the construction pipeline is thinning considerably, which should help the market regain equilibrium. Currently, only one major project, a 187,500 square foot facility, is under construction. This slowdown in new development aligns with national trends and is expected to lead to tighter market conditions in the future as demand catches up with existing supply.

Rents and Market Segments

Despite rising vacancy, asking rents in Alamance County have grown 3.4% year-over-year, more than double the national average rent growth of 1.4%. The average market-wide rent now stands at $6.22 per square foot. Rents vary by asset type, with tenants seeing the following averages:

Logistics: $6.58/SF

Flex: $13.05/SF

Specialized Industrial: $5.42/SF

Source: CoStar Market Research

Investment and Economic Outlook

Investment activity in the Alamance County industrial market remains measured, with $22.4 million in sales volume across 25 transactions over the past year. The estimated market price for industrial assets in Alamance County is $63 per square foot, which presents a significant value compared to the national average of $160 per square foot. Furthermore, the local market cap rate of 8.1% is notably higher than the national average of 7.2%, signaling attractive returns for investors.

On the macroeconomic front, there are encouraging signs for the industrial sector. U.S. factory activity experienced its sharpest expansion in over three years this past June. More importantly, the Federal Reserve cut its benchmark interest rate by 25 basis points in September, a dovish move that is expected to provide relief for developers and could stimulate new investment and business expansion. While the labor market has shown signs of cooling, the recent rate cut may help invigorate economic activity heading into 2026.

Looking Ahead

The Alamance County industrial market is clearly in a transitional phase. While higher vacancy presents a short-term challenge, the underlying fundamentals point toward future stability and growth. The dramatic reduction in the construction pipeline is the most critical factor, setting the stage for vacancies to compress as demand inevitably absorbs the current supply. For investors and owner-occupants, the market's attractive pricing and higher-than-average cap rates present a compelling opportunity. As the impacts of lower interest rates begin to materialize, we expect to see renewed momentum in leasing and investment activity in the coming quarters.